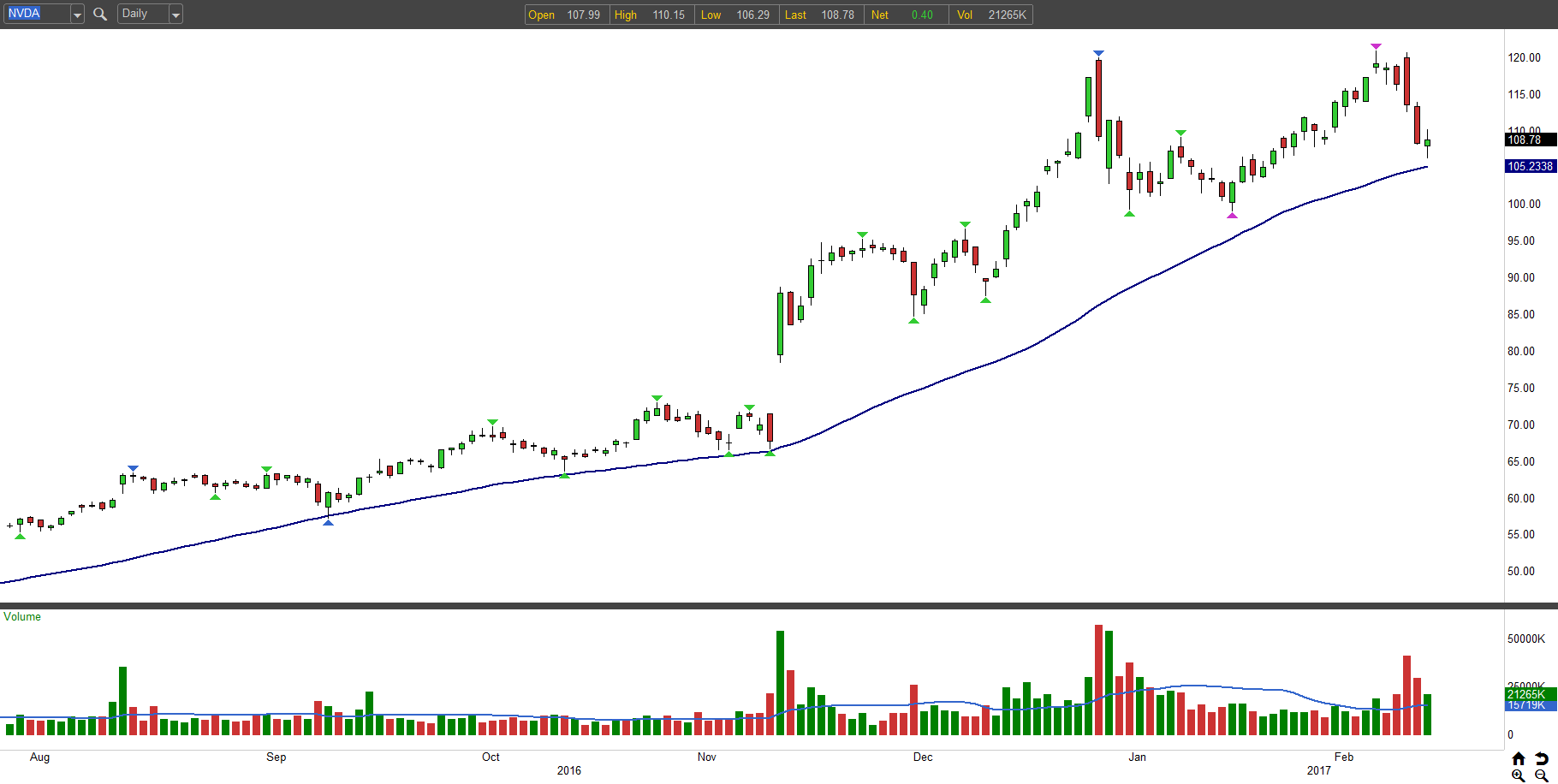

We expect to see sequential growth recovery in the company's two core segments: Gaming and Data Center. We believe NVDA has hit its inflection point and is now eyeing a broadening addressable market within the semi-space: AI chips.

The company reported $6.05B in revenue versus the expectation of $6B, and EPS came in as $0.88 compared to an expectation of $0.81.

NVDA stock surged more than 8% in extended trading this Wednesday after beating top and bottom line estimates. We believe the stock provides a favorable risk-reward profile at current levels. We're more constructive on NVDA now than we were a year ago, as we expect the company's serviceable available market (SAM) expands as it joins the AI bandwagon. We believe NVDA is doing well to return its gaming supply to a more normal total addressable market (TAM) after the severe downside from crypto-mining-related GPU sales has been priced into the stock and outlook. We believe NVDA is rebounding toward 2H23 and expect the company to experience significant demand tailwinds driven by its new product cycle and hype around Artificial Intelligence (A) chips. We remain buy-rated on NVIDIA Corporation ( NASDAQ: NVDA) post 4Q23 earnings results.

0 kommentar(er)

0 kommentar(er)